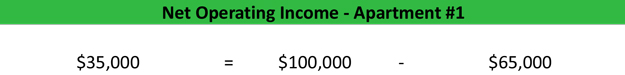

NOI is primarily used when a real estate investor wants to determine the expected profitability of a rental property. Another thing to remember that separates the two formulas is that NOI is calculated before income tax deductions but includes property taxes. You must generate the total calculation of GOI before formulating NOI. NOI and gross operating income do often coincide, however. Gross Operating Income = Gross Potential Income – (Vacancies and Losses) Gross Operating Income is calculated as follows: The two can cause some confusion in real estate, as many assume they are interchangeable in determining a property’s value. NOI is different from gross operating income (GOI). Gross Operating Income vs Net Operating Income Therefore, it doesn’t apply to the net operating income. For example, covering an emergency repair may come out of a property owner’s savings. Excluded expenses are any costs that don’t support the overall value. Remember, real estate investors use NOI calculations as insight into a property’s value through the lens of cash flow. Large expenditure costs for major repairs.Items that are typically excluded from net operating income calculations include: Several expenses are not included in the standard NOI calculation. Knowing the NOI equips you to make necessary adjustments to maximize your profit potential. Similarly, NOI allows you to objectively assess a property that might not generate profit. In other words, your net operating income is the funds you keep while operating your investment property.Īn NOI calculation is critical if you want to project and acquire a profit. Operating expenses are the costs you pay to run your property. Extra amenities, such as coin laundry or vending machines.In real estate investing, total operating income is made up of: This accounts for not only rental income but all the additional revenue generated on the property. Total operating income includes all of the income (also known as revenue) you make from a property. Net Operating Income = Total Operating Income – Operating Expenses

Additionally, you must calculate all property operating costs. To calculate net operating income, you first need to know your gross operating income. Get the Net Operating Income Your Property Needs.

0 kommentar(er)

0 kommentar(er)